Orca Global: August + September 2023 Investment Newsletter

Disclaimer: This page, including any links or posts, is not an offer or invitation to subscribe for shares in the fund. Please read the full disclaimer at the end of this page.

NOTE: This newsletter was originally sent to investors of Orca Global Management on 19th October 2023. Sensitive information has been redacted.

Market Review

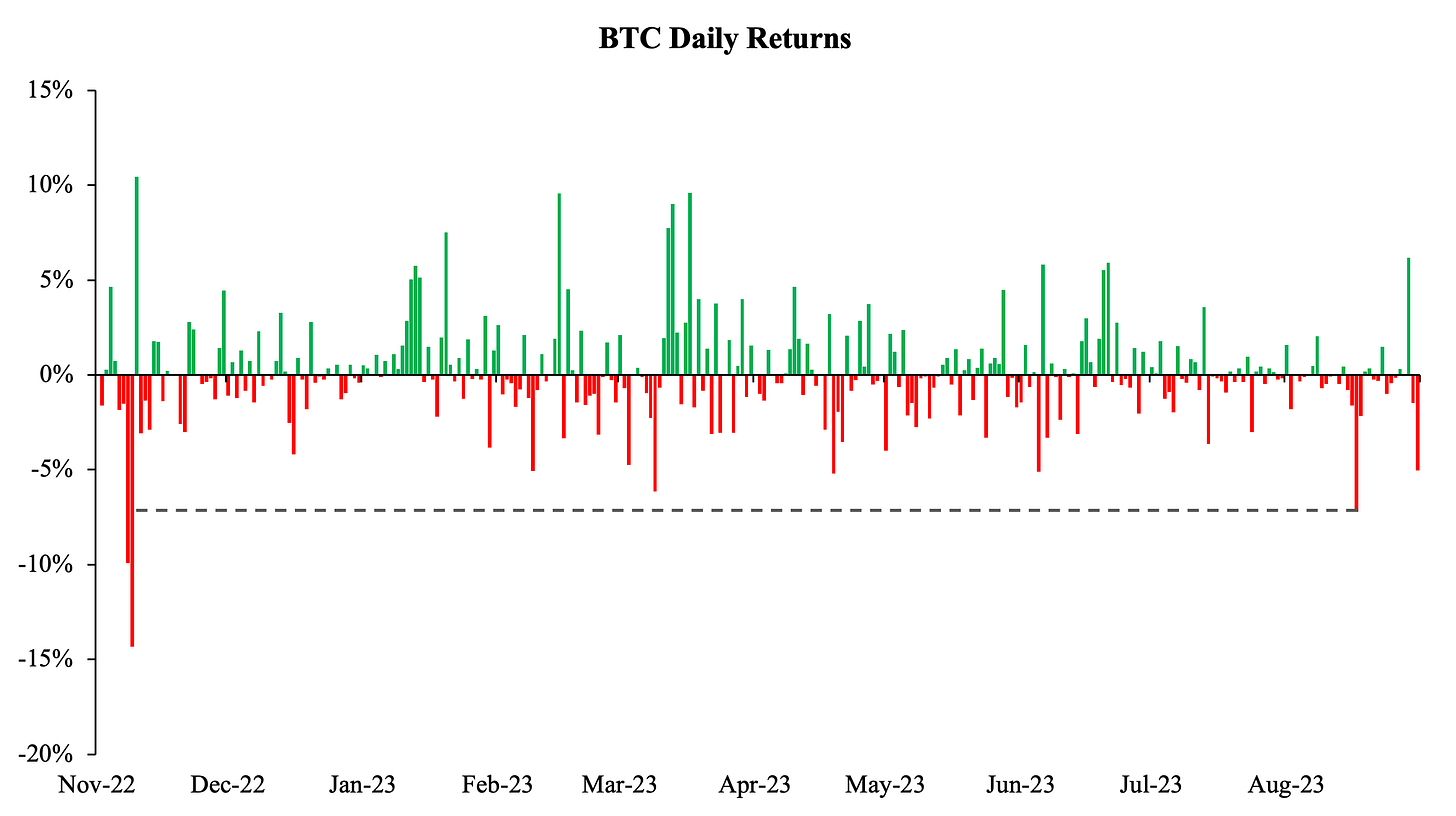

With almost all coins down double-digit percent in August, BTC had its worst monthly performance of 2023 and the worst since November 2022 (when FTX went down). The market returned slightly in September, with BTC and ETH finishing the two-month period -7.9% and -10.2% respectively (Figure 1). The extreme August price action was driven from a 17th August WSJ article that mentioned that Elon Musk’s SpaceX had written down the value of its crypto holdings by $373mm over the course of 2021 and 2022.

The article was titled "A Rare Look Into the Finances of Elon Musk’s Secretive SpaceX”, and interestingly, the topic wasn’t even on cryptocurrencies specifically. The part that scared digital assets investors, quoted below, was quite literally just the last paragraph in the entire article and seemed nothing more than a “oh by the way they also marked down their crypto holdings”:

“The documents also show SpaceX wrote down the value of bitcoin it owns by a total of $373 million last year and in 2021 and has sold the cryptocurrency. Tesla has taken a similar approach with its bitcoin holdings. Musk has posted about cryptocurrencies frequently over the years.”

If “wrote down” is used here in the conventional sense, then all this is saying is that a private company took an accounting action to update the value of one of its assets to reflect market prices… but it was enough to create the worst month for crypto in 9-months. Here are more stats for 17th August:

The largest one day fall in prices also since November last year.

The biggest long liquidations in BTC futures in USD terms since May 2022 when the Terra ecosystem collapsed. When measured in BTC terms, it was the largest since FTX’s collapse. This includes term (quarterly) and perpetual futures on the top 9 centralised exchanges (CEXs).

The largest weekly drop in futures open interest (OI) since December 2021. This data is also from the top 9 CEXs.

The news was fairly “non-news” in our minds, but it was evidently enough to cause some of the most violent derivatives stats for at least 2023, and even since the start of this bear market in December 2021. The data speaks to the amount of long positions that chased the move after the BlackRock ETF headline rally in June this year.

Trading and Our Views Going Forward

In August we scaled out of our Systematic Delta-Neutral Arbitrage strategy (introduced in our April newsletter). Since its launch in March, the strategy returned an annualised 12.97% with a sharpe of 5.31 (rfr = 2%). The decision to scale out was a product of (1) risk mitigation, and to (2) maximise PnL based on our view of the current market regime:

A deterioration in market liquidity: we need to stay within our internally set risk-limits to allow all positions to be closed and all assets to be brought back into self-custody within an hour.

Since this strategy relied on cross exchange arbitrage and hedging, lower volumes and thin orderbook depths can be a risk when markets experience sudden large moves.

In fact, the strategy’s worst day was in June when markets were whipping and gapping higher after market makers withdrew liquidity in the BlackRock ETF headline driven rally.

Rotation of strategies: as we wound down the arbitrage strategy in August, we started accumulating long BTC positions. However, given our view on the market, we then rotated this into a beta-neutral RV strategy in September.

This RV strategy is a modification of the one we ran on FTX last year. Details of the previous RV strategy is as follows: live from 10 Aug 22 to 08 Nov 22 (90 days), 47.21% annualised return, 5.00 sharpe (rfr= 2%), -0.07 correlation to BTC, and a 30d 95% VaR of -0.73%.

The newly launched version is also a highly liquid, thesis driven delta-neutral strategy, however this version is estimated to experience higher volatility than last year’s one. We also combined some elements from the Systematic Delta-Neutral Arbitrage strategy to add additional yield to this new RV strategy.

According to Kaiko Research, by August this year, BTC’s 2% market depth, a measure of liquidity via aggregating the volume of BTC in the orderbook +-2% away from the mid, was down more than 60% since October 2022 (measured in CEX’s BTC/USD and BTC/USDT pairs); meanwhile, Binance’s 1% orderbook depth in all of its BTC pairs was down more than 40% from Q1 to Q2 of 2023. This lower liquidity regime has been painfully evident to us during both manual and systematic execution of trades in the last couple of months. When we analysed our live PnL in the arbitrage strategy, it was clear that broad liquidity issues was why it’s live results were underperforming both its backtests and 1Q23 live testing; wider bid/ask spreads, a greater number of periods in where positions were not fully hedged due to less market takers, as well as an increase in adverse selection hits.

Other strategies: the BTC Systematic Momentum strategy was down roughly 2.1% throughout August and September (versus -7.9% for BTC).

Another interesting market observation: this current “dip” that we are in, is the first time this year that a higher low hasn’t been sustained as the August dip caused BTC to fully round trip from the BlackRock headline rally (Figure 5):

Since the world’s largest asset manager filed for a spot BTC ETF application with the SEC in June, the market consensus regarding a spot ETF approval has gone from skeptical to near-certain, yet BTC is back from the post-BlackRock high of almost $32,000 to around $27,000.

It’s hard to justify BTC’s prices here in an isolated analysis so we believe macro factors - particularly the continued sell-off in duration and rally in USD, as well as the price action since July of lower equities, lower gold, and fewer rate cuts prices in for 2024 - have been driving the price action from mid-summer.

Since the BlackRock application, and as we move closer to the SEC’s deadline to announce a decision, we have had numerous headlines and updates regarding the spot BTC ETF (want to mention here that we have covered some of these headlines in a newly started weekly commentary where we explore some market data as well as a headline of the week, published on our LinkedIn page in conjunction with Laevitas, a crypto derivatives analytics platform). As with anything, there is a lot of noise around the highly anticipated decision, but our one line tl;dr would be that the odds of an approval continue to creep up as there have been minimal unforeseen headwinds, and we expect a decision to be given for most, if not all, BTC ETF applications in the SEC pipeline by 10th January 2024, which is the final deadline for ARK 21Shares’ refiling (a quasi-complete table on the current filings and their respective deadlines can be found in Figure 2 of the July newsletter). We continue to believe that BTC has not priced in a world in which many of the world’s largest asset managers own physical bitcoins and push their BTC spot ETFs on to their clients.

March 2023 was a revealing period for BTC as we found out its true properties and where it belongs in the realm of global assets. Like we detailed in our March newsletter, BTC clearly failed at its long touted categorisation as an inflation hedge, evidenced throughout the high inflation years of 2022 and 2023 (although many, including Cathie Wood, still claim it to be). What this year’s banking crisis taught us however, was that BTC is in fact a “hedge”, but its purpose is nuanced: it is an asset that hedges against the confiscation of wealth and counterparty risk. BTC has always struggled to define itself in the global multi-asset world, with strategists and fund managers categorising it as anything from digital gold to a risk asset to an inflation hedge (or anything in between). We think having a clearly defined categorisation - as a hedge against the confiscation of wealth and counterparty risk - which is unique to this decentralised fixed-supply digital asset, is incredibly bullish for BTC and the crypto market’s years ahead.

In next month’s newsletter, we will explore our views on BTC versus ETH (and other alts), as well as analysing the crypto market by looking at institutional flow.

Further Disclaimer:

The following important information relates to the use of Orca Global Management’s substack publications. Orca Global Management is a fund registered in the Cayman Islands. This publication is directed only at persons who: a) Are expert investors who fall within the definition of Accredited Investor b) Are otherwise permitted to read this publication in compliance with the governing laws of their respective jurisdiction. It is not directed at or intended for retail clients nor general public dissemination. Any person considering an investment into Orca Global Management’s fund must ensure that they are suitably qualified, experienced and knowledgeable on such investments considering jurisdictional rules, regulations and restrictions, tax implications, residence or domicile and their financial circumstances. Past performance is not a guide to what may happen in the future. Prospective investors should be aware that the value of their investments could fall as well as rise. Any investment carries the risk of potential total loss of capital and investors may not get back the value of their original investment. Information on this publication may include data and opinions derived from third party sources. Orca Global Management does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. Furthermore, the information provided does not constitute an offer to buy or to sell cryptocurrencies or any other financial instrument, nor does it constitute investment, legal or tax advice. Details relating to the investment including the risk disclosures can be found in the Private Placement Memorandum. This brief statement cannot disclose all the risks and other significant aspects of the various markets traded by Orca Global Management.