Orca Global: December 2022 Investment Newsletter

Disclaimer: This page, including any links or posts, is not an offer or invitation to subscribe for shares in the fund. Please read the full disclaimer at the end of this page.

NOTE: This was written on 18 January 2023 and originally sent to investors of Orca Global Management on 21 January 2023. Sensitive information has been redacted.

December market review

December was a quiet month with the market still processing the FTX incident from November. There was very much a heavy air of wanting to get 2022 done and over with.

Liquidity was painfully thin and participants tired: Kraken, one of the oldest crypto exchanges, had its lowest volume month in BTC/USD spot trading since December 2016.

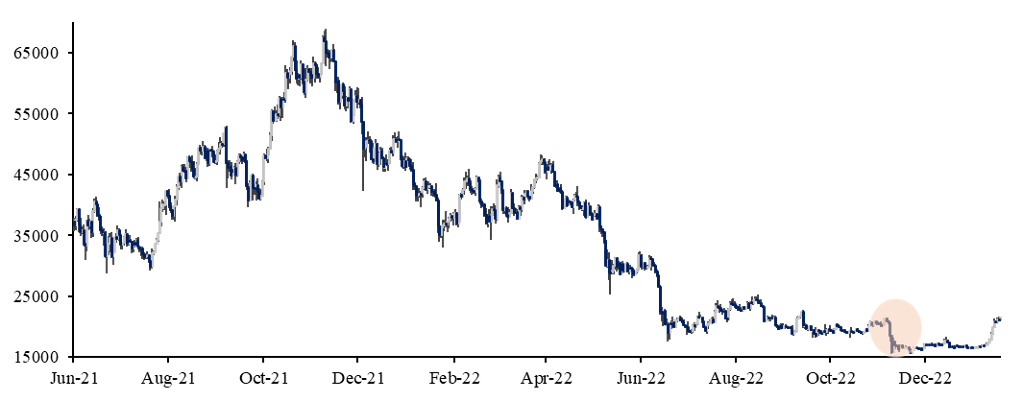

Price action was appropriately dreary as traders were still in mourning the fall of Sam Bankman-Fried’s empire. Coins were broadly down single~double digit percent on no catalyst (Figure 1). Volatility was also down across all tenors (more on that later in Figure 5a & 5b).

[——— paragraph redacted ———]

Our current views

The biggest question now is: is the bottom in yet?

The same question was asked after each of the double-digit % dumps last year, and more notably, immediately after the 3 crashes of 2022: Terra, 3AC, and FTX. And each time (except for the latest FTX), the market replied with an assertive “no” by finding another bearish catalyst.

So is it different this time?

As of current (writing on 18Jan23), BTC in January has effectively made back the losses from the FTX incident (Figure 2).

We are currently in an interesting macroeconomic backdrop where the biggest debate is whether or not the Fed can perform a “soft-landing” (= act of bringing down inflation without inducing a recession).

Despite consensus for recession odds being ~65%, our belief is that the actual odds are lower if the drag on growth from recent policy tightening is shorter than what the market expects. As Jon Chryssafis at Goldman Sachs notes, based on their FCI framework, the estimate is that “peak” drag has already happened in 4Q22 with an expectation that the effects are set to dissipate almost entire by the start of 3Q23. Further, his view is that the labour market can continue to rebalance without a recession as job openings fall further alongside only a limited increase to the unemployment rate. If growth drag effects diminish from here whilst the labour market readjusts as to not create meaningful damage (via higher unemployment), this would put the US economy in a pretty encouraging place.

For now, the market seems to have marked 5% in short-term rates as the peak (Figure 3), which risk assets seem to like: spoos are back above its 200DMA and trying to push past its long-term downwards trendline, both of which have been strong resistance (Figure 4).

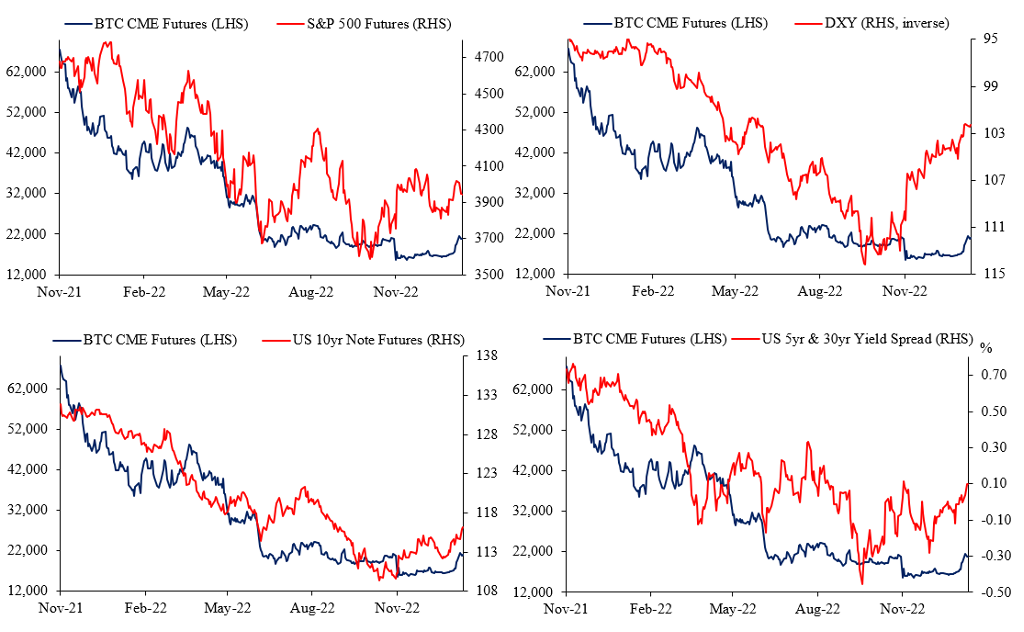

The moves in crypto this month in January have largely been driven by short squeezes (seen in futures positioning data). The environment was ripe for a move with realised volatility being heavily suppressed post-FTX (Figure 5a, 5b) and the FTX event putting the crypto x macro correlation out of whack (Figure 6).

Figure 6 shows that the timing of the FTX incident came right as the macro wind shifted, and we were probably due for some catch-up.

The short squeezes this month have been some of the largest ever recorded in crypto. The combination of the new year, thin books, and large short futures positions to hedge spot balances proved to be ruthless - after a dormant December, the options market roared back to life this month, but limited to short-tenors. Figure 7 shows the couple of weeks of low vol across the new year, before spiking from ~8% to ~50% within a few days:

Although careful of any signs that this is an “echo-bubble”, with a lot of short-term trend indicators finally showing signs of a reversal, we are cautiously optimistic to build directional exposure.

Outside of these more technical and market micro structure driven moves, the focus in the industry has been in Liquid Staking Derivatives (LSDs). This is the focal point of our current views and two of our live-strategies revolve around this topic so we will give a brief introduction as to what these are:

Liquid Staking Derivatives

Liquid Staking Derivatives (LSDs) are on-chain derivative instruments that allow traders/investors to gain exposure to the potential returns of staking cryptocurrency assets, without actually having to hold or stake the underlying assets themselves.

Examples:

Staking derivative contract: a type of smart contract that allows users to purchase the right to share in the rewards earned from staking a particular cryptocurrency e.g. purchasing a staking derivative contract for a certain amount of $ETH would entitle you to receive a portion of the staking rewards earned from that $ETH, without actually having to hold or stake the $ETH yourself.

Staking-as-a-service product: allow users to earn staking rewards by depositing their cryptocurrency assets with the service provider, who will then hold and stake the assets on their behalf.

In both cases, the goal of LSDs is to make it easier for users to earn rewards from staking cryptocurrency assets, without having to go through the process of setting up and maintaining a staking infrastructure themselves. This can be especially useful for users who may not have the technical expertise or resources to set up their own staking infrastructure, or who may prefer to have a more hands-off approach to staking.

The top liquid staking protocols, where users can stake their Ethereum, are Lido, Coinbase, Rocket Pool, Stakewise, Ankr, Frax Finance, etc.

Why this sub-sector of DeFi has gained attention recently is the upcoming Ethereum Shanghai hard fork, which is expected to happen in March/April this year. Currently, stakers of Ethereum face a major liquidity issue in which the staked-ETH cannot be unstaked. After the Shanghai hard fork, unstaking can freely happen.

Due to this constraint Ethereum has a much lower staking ratio than its competitor chains do: Ethereum’s taking ration is ~14%, compared with 90% BNB, 72% ADA, 68% SOL, 62% AVAX, and 46% DOT (stats as of mid-December 2022).

However, as mentioned, there exist protocols in which you can stake your Ethereum for a yield. Currently, with no withdrawals, liquid staking protocols spend the majority of emissions on maintaining the staked ETH derivative / native ETH peg. Kind of like a central bank fighting one way flow to maintain their currency’s peg, this is obviously a costly exercise. Our trades revolve around the freeing of this constraint.

Interesting Events in December

1) Kraken announced that the exchange was cutting 1,100 staff (30% of total workforce).

2) According to Reuters, Goldman Sachs plans to spend “tens of millions of dollars” to buy or invest in crypto firms after FTX’s collapse.

3) Polygon and Warner Music Group have joined forces with LGND.io (an e-commerce platform) to launch a multi-year web3 music program. This will allow users to play digital vinyl on-the-go.

4) The Australian government plans to establish a framework for licensing and regulating crypto service providers in 2023.

5) Donald Trump launched his own NFT trading card collection (total of 45,000) which sold out within a few hours.

6) Fidelity filed 3 trademark applications in order to provide services in the metaverse and virtual worlds.

7) Gemni and the Winklevoss twins are facing a potential class action lawsuit for failing to register Gemni’s interest bearing accounts as securities.

Further Disclaimer:

The following important information relates to the use of Orca Global Management’s substack publications. Orca Global Management is a fund registered in the Cayman Islands. This publication is directed only at persons who: a) Are expert investors who fall within the definition of Accredited Investor b) Are otherwise permitted to read this publication in compliance with the governing laws of their respective jurisdiction. It is not directed at or intended for retail clients nor general public dissemination. Any person considering an investment into Orca Global Management’s fund must ensure that they are suitably qualified, experienced and knowledgeable on such investments considering jurisdictional rules, regulations and restrictions, tax implications, residence or domicile and their financial circumstances. Past performance is not a guide to what may happen in the future. Prospective investors should be aware that the value of their investments could fall as well as rise. Any investment carries the risk of potential total loss of capital and investors may not get back the value of their original investment. Information on this publication may include data and opinions derived from third party sources. Orca Global Management does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. Furthermore, the information provided does not constitute an offer to buy or to sell cryptocurrencies or any other financial instrument, nor does it constitute investment, legal or tax advice. Details relating to the investment including the risk disclosures can be found in the Private Placement Memorandum. This brief statement cannot disclose all the risks and other significant aspects of the various markets traded by Orca Global Management.