Orca Global: February 2023 Investment Newsletter

Disclaimer: This page, including any links or posts, is not an offer or invitation to subscribe for shares in the fund. Please read the full disclaimer at the end of this page.

NOTE: This was written on 15 March 2023 and originally sent to investors of Orca Global Management on 20 March 2023. Sensitive information has been redacted.

Part I: What doesn’t kill us

We are currently in a defining phase of the digital assets space. Never has the industry faced so many consecutive threats to its very existence. After losing over $2 trillion in market cap - over 75% of the industry’s value wiped out over the course of a year - and losing the majority of the industry’s core actors, those who are left standing today have shown a remarkable desire to not only survive but to also grow this ecosystem in which we still believe will be a source of tremendous innovation and wealth creation.

From late-2021, the effect a rapid increase in real interest rates and a tightening of financial conditions had on duration assets was brutal: this macro backdrop collided head on with global supply-chain issues and a land war in Europe to generate a storm that struck at inflated assets with pitiless precision. Fresh off a prodigious bull run and high on leverage, crypto was defencel

ess against the waves of attacks. Those of us in the industry watched this unfold from the front lines, seeing every gory detail of this unforgiving storm up close and personal, as the most prominent figures got carried out on stretchers and countless more soulless bodies floated up to the surface after each relentless attack by the storm. Each time the storm passed, we would discover that more and more of our acquaintances and friends had become victims; with emotions high and self-preservation instincts in overdrive, many survivors scrambled for the exits and fled back to the shelters of traditional finance and tech. Those of us that remained were consoled by politicians and mainstream media in the form of public vilification by association.

Yet we pushed on, each of us busy rebuilding our own homes and bandaging our wounds whilst refining our roles for the ultimate goal of strengthening this innovative industry for what will be a long future ahead: investors adjusted their risk management parameters, engineers tackled the industry’s weaknesses, and founders explored new frontiers.

Grit and a long term outlook is a prerequisite to survival in this space. It is our belief that the majority of the wealth in crypto is created in bear markets not only because prices are depressed but also as a reward for sticking to it whilst the majority lose interest and move on. There is no “timing the bottom” when you are involved in the space every day. You will inevitably be picking up coins at below fair value and will soon be rewarded for not wandering off. The question is, how soon is “soon”?

This storm, which has not passed yet, has been calamitous for all and for many, even fatal: the largest hedge funds in the space, the number two exchange by volume, essentially all the lenders, a top-5 cryptocurrency ecosystem by market cap, the largest brokers in the space, many of the biggest algorithmic market-makers, two of the only crypto-friendly banks… the list of victims goes on.

With each catastrophe we rebuild our homes stronger and strengthen the ecosystem for the next attack by the storm. And despite the damage the storm has caused, last month was another all-time-high in crypto options volume and just this week we had the highest bid volume in CME BTC futures in almost four years.

There is a famous saying on the topic of resilience through adversity, reworded from Nietzsche’s writing "What does not destroy me, makes me stronger.” Something about what doesn’t kill us…

Part II: Inflection Point

This section is being written in the late hours of the 15th of March, right after the NY close as chaos continues to unfold. We’re currently experiencing historic days in the macro markets: headlines that read “BIGGEST ONE-DAY MOVE SINCE [insert 2020 or 2008 or 9/11 or 1989 or EVER]” have been printed non-stop over the last few days. Interest rate markets in the US and Europe (as well as some other smaller economies as collateral damage) are facing a never-seen-before volatility.

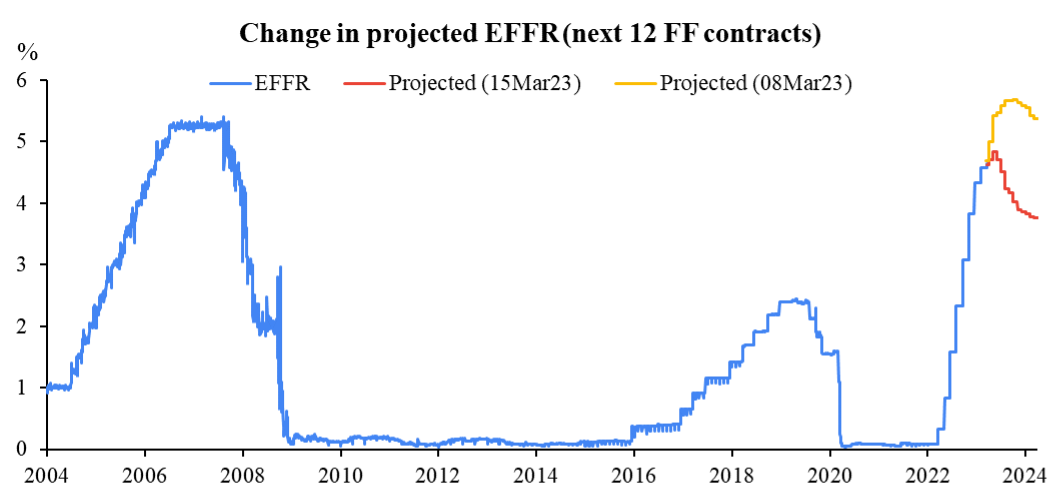

Just look at how the failure of Silicon Valley Bank (as well as Signature Bank) re-priced the front end of the Fed Funds curve (Figure 1):

The interest rate markets went from leaning towards a 50bps hike a week from now to now leaning towards no hike at all. Complete pivot in this one week, now assuming that the Federal Funds rate in one year (March 2024) will be at least 6 cuts lower (161 bps) than it predicted a week ago. And it was just last week that Fed Chair Powell went all guns blazing at his Congressional Testimony to re-iterate that the Fed had more tightening to do, that core inflation had not come down as fast as he had hoped so they have a long way to go, that the ultimate rate peak will be higher than expected, inflation is running higher than expected, etc., among other hawkish comments… not quite the forward guidance to warrant an unprecedented rally in short-term rates. Particularly when month/month core inflation came in hotter than expected this week. But such is the significance of this potential banking crisis.

As the title of this section suggests, we believe that we are currently at or approaching an inflection point:

As seen in Figure 1, whether you believe we are following the yellow or red interest rate projection, we correspond to somewhere around the red arrow in Figure 2. As the effect of changing interest rates has a lag, a year after the first hike of this cycle, certain areas of the markets are just feeling the pain of tighter financial conditions. Adjusting interest rates is much like steering a cruise ship: the effect of steering the ship isn’t immediate and once momentum builds, even when you turn the rudder back straight, the ship will keep moving in the original direction for a while before stopping. This is to say that the true effect of your hiking cycle - to know which direction the ship will point towards - is only revealed with a lag after you stop hiking. If you turn the wheel back to straight only once you’re pointing in the direction you want to head in, your ship will oversteer. And Captain Powell is coming to grasps with the difficulty of this nuisance as he approaches the red arrow in Figure 2, which has only been complicated with the demise and instability of a few US banks.

There are two takeaways from his Congressional testimony last week, one direct and one indirect:

The direct takeaway is that the Fed thought interest rates needed to be a lot higher and held there for much longer than the market was expecting.

The indirect takeaway is that if Powell knew that a mid-sized bank was going to go under within the week, he wouldn’t have gone full guns blazing to impress and reassure lawmakers that the inflation their constituents faced was the devil himself and that the Fed would do anything to destroy it. This also implies that he didn’t know what was going on in his house (the US banking sector) and that in the days following Silicon Valley Bank’s collapse, there were probably a lot of meeting and projections going on at the Fed to determine if the banking system could withstand another hike (as well as calls from the White House).

We believe that the response from the Fed going forward, on all matters under their jurisdiction, has to be incredibly nuanced. Inflation is still hot and unemployment still low. It is absolutely NOT the time to pivot policies or start QE, but rather to implement some very targeted policies (/responses) specific to the banking issue at hand (which we have already started to see). This translates into the view that there will be a 25bps hike next week (which right now is the minority view) and that the Fed will not continue with this semi-explicit banking backstop but show the markets that they are sticking to their inflation fighting mode.

So… how does this translate into positions?

The same simplistic big picture view we saw in Figure 2 done for markets looks like this:

Timing markets is much harder, hence the shaded rectangle instead of an arrow. With high conviction, due to publicly available information regarding inflation and labour markets, as well as the Fed’s forward guidance, we can say that we haven’t reached the peak for interest rates for this current hiking cycle. But with risk markets being an indirect derivative of the rates market (e.g. via duration sensitivity) whilst also being influenced by a myriad of other factors, the range of possibilities as to where in the cycle we are becomes much more difficult to determine. If we knew that price of a stock would rise tomorrow, we would buy the stock today. If everyone else also knew, they would front-run the move and the price of the stock would rise today. Which is why, when we combine Figure 2 and Figure 3, we get something like this:

It is subtle but you can see that the market trough is set before the rates peak is.

It is in these regimes that markets stop trending, liquidity dries up, and signals start to break. Weak hands are flushed out and the post-capitulation depressions sets in. This sine wave paints a smooth and short bounce, but often times this regime can last weeks or months (or years if we look back and study market history). The feeling of hope is replaced by despair and market participants give up on “waiting for the bull run”. This is especially true for markets such as crypto, where the short history makes it much harder to swallow the coping medicine stock/real-estate investors take during bear markets: telling yourself “in the long run, it will always go up”.

It is our strong belief that these are the most difficult regimes in which to have an edge as an investor or trader, and the way in which to maximise the EV of your portfolio with a 2~3 year outlook, is to have cash to deploy when you think the time is right. The illiquidity in the markets cause exacerbated moves that are detached from fundamentals whilst simultaneously nullifying signals from technical analysis. Combine these market conditions with the fact that there are far more unpredictable event-driven moves (e.g. a bank failing, a protocol being hacked, an exchange going under - these are things that happen far more frequently in bear markets than in bull markets), it becomes increasingly difficult to manage positions effectively. Actively managing your positions becomes negative expectancy. As an extremely crude example, we can take an asset that has IID (independent and identically distributed) daily returns with zero-mean. Under the most simple assumptions, all trading strategies here have negative expectancy, and will approach zero faster the more frequent the trades are and the larger the positioning. Of course this doesn’t take into account autocorrelations / non-daily returns / non-linearity / convexity / etc. so it is not realistic but still a great example to showcase the difficulty of active trading in such regimes (particularly when you are often paying to trade, whether by spread-crossing or fees).

To put this altogether and translate the above into how our portfolio is currently structured, we believe that these are times we need to be patient and maintain our longer-term outlook. It is vital that we are not sucked into active trading by a fake calming of the storm. Our focus is in the EV of the fund a few months from now, not mark-to-market monthly returns. We do not want to miss the next 2~300% bull run by being focused on 2~3% intraday trades. Most allocations to our strategies are currently zero as we overweight cash in this regime, except for 2 uncorrelated strategies: a medium-term systematic momentum strategy and a delta-neutral funding rate strategy. We are confident that we are approaching this inflection point in the markets so our current priority is to consider the components of our potential long portfolio so that at any given moment we can deploy into the next narratives of crypto, whilst continuing to be mindful of macro conditions.

Further Disclaimer:

The following important information relates to the use of Orca Global Management’s substack publications. Orca Global Management is a fund registered in the Cayman Islands. This publication is directed only at persons who: a) Are expert investors who fall within the definition of Accredited Investor b) Are otherwise permitted to read this publication in compliance with the governing laws of their respective jurisdiction. It is not directed at or intended for retail clients nor general public dissemination. Any person considering an investment into Orca Global Management’s fund must ensure that they are suitably qualified, experienced and knowledgeable on such investments considering jurisdictional rules, regulations and restrictions, tax implications, residence or domicile and their financial circumstances. Past performance is not a guide to what may happen in the future. Prospective investors should be aware that the value of their investments could fall as well as rise. Any investment carries the risk of potential total loss of capital and investors may not get back the value of their original investment. Information on this publication may include data and opinions derived from third party sources. Orca Global Management does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. Furthermore, the information provided does not constitute an offer to buy or to sell cryptocurrencies or any other financial instrument, nor does it constitute investment, legal or tax advice. Details relating to the investment including the risk disclosures can be found in the Private Placement Memorandum. This brief statement cannot disclose all the risks and other significant aspects of the various markets traded by Orca Global Management.