Orca Global: March 2023 Investment Newsletter

Disclaimer: This page, including any links or posts, is not an offer or invitation to subscribe for shares in the fund. Please read the full disclaimer at the end of this page.

NOTE: This newsletter was written on 24th April 2023 and originally sent to investors of Orca Global Management on 28th April 2023. Sensitive information has been redacted.

This newsletter will be broken up into two segments:

March Performance: a thorough review of March returns and what drove our PnL.

March’s BTC Rally: market analysis on why $BTC led an almost solo rally after a sharp sell-off fuelled by the banking sector.

1. March Performance

The Fund’s negative PnL driver in March was primarily from the self-liquidation of our positions. Following the FTX incident last year, we defined a few high risk scenarios that would trigger responses ranging from a full analysis of the Fund’s exposures to ultimately liquidating all of our positions and returning to 100% self-custody i.e. we identified situations where an elimination of both delta and counterparty risk was necessary. Last month two of those scenarios transpired, triggering our emergency response protocols. The first was the failure of the crypto banks. The second was the subsequent de-pegging of USDC, the asset-backed USD stablecoin issued by Circle.

1.1 The Crypto Banks

Last November after FTX’s implosion, there were numerous liquidity concerns regarding Silvergate Bank, the then-largest “crypto bank” (provider of on-ramp and off-ramp), and its shares tumbled sharply. Back then, as we revamped Orca Global’s risk management measures, we made the decision that serious rumours regarding - and ultimately failures of - crypto exchanges and crypto banks to be the most serious threat to both the industry and specifically Orca’s performance. Even if our balances or positions are not directly affected, events in 2022 revealed that it is unclear where leverage is embedded, what coins are used as margin, and the extent to which anyone can be collateral damage in ensuing unwinds.

In February rumours regarding Silvergate’s liquidity started heating up and in March the bank’s deposits started declining rapidly. On 08th March, Silvergate’s liquidation was announced. At this point our alerts to start reducing positions were set off but crypto was surprisingly resilient on the announcement, presumably because the industry still had Signature Bank, the other large US bank holding company that facilitated on-ramping and off-ramping. With no reaction from the market and no USD transaction facilitation issues with any of our exchanges or OTC market makers (as Signature Bank’s networks were working fine), we decided to hold off a full scale liquidation and reduction of counterparty risks for now (as this is a costly exercise when done with urgency), and only resume if any legitimate concerns regarding Signature Bank (the Fund’s bank account at the time) arose.

The market’s attention immediately turned to Silicon Valley Bank (a VC/fintech focused bank) which on the same day of Silvergate’s collapse, launched a $2.25bn stock sale to shore up its balance sheet. The next day on the 09th, SVB’s shares sold- off 60% and at this point it was clear that another US bank was spiralling into failure. Rumours about Signature Bank started surfacing and its stock price dropped 10%. We conducted a risk meeting and as planned under our emergency measures, made the decision to close all directional positions and bring back all assets under self-custody. It was at this time we also converted our tiny remaining cash held at Signature Bank into USDC to be held under self-custody (to limit counterparty risk we had moved out most of our assets from Signature Bank after the FTX incident but had left a small balance for the fund’s USD fiat payments). NY State banking officials announced the closure of Signature Bank two days later.

1.2 USDC Depeg

With Tether, USDC’s more adopted (/higher market-cap) rival, experiencing controversies throughout recent years, our non- positional balances had predominantly been in USDC. However, during the mini-banking crisis, it was revealed that Silicon Valley Bank was one of 12 banks that Circle held its assets in. With only vague information released from Circle in the midst of SVB’s bank run, people started selling their USDC for USDT and USD. We had no idea what percentage of reserves was at risk or how Circle’s asset-liability balance was changing as people redeemed USDC at par. Our internal system started alerting us with USDC’s depegging against USD: 20 bps, 30, 40, 50, 60bps... At 50 bps an internal limit was breached and we conducted a final review before deciding to swap out all our USDC.

The facts at the time were simple:

Circle had an unknown amount of assets (reserves) stuck in Silicon Valley Bank;

No one knew if SVB (or the US Treasury) would make Circle whole on its assets;

Circle has always been proud to be holding their reserves in cash and US Treasuries (”USDC is 100% collateralized with a combination of cash and US Treasuries” as stated on their website). We had no idea what their mark-to-market losses were on their UST holdings, and it was prudent to assume that they too had significant losses, given that duration risk was what started this whole mini banking crisis;

There was a possibility that they had more assets at risk in other places not yet publicised (which was exactly the case as they had cash in Signature Bank that was seized by the US Treasury only days later);

We had no idea what their balance sheet looked like and how their asset-liability ratio was changing as they continued to redeem USDC holders 1-1.

On a higher level, there exists some depeg level before -100% at which the value of a stablecoin in its abstract becomes worth $0.00. Of course, if a stablecoin issuer is able to redeem their tokens for 80c on the dollar, then that stablecoin is worth $0.80. But there is absolutely no use for a coin in crypto to be pegged to 0.80 USD. Zero use. So the decision was made to exit our USDC holdings entirely, and this was executed at a 50~100bps loss. In the following days, USDC depegged 12.6% against USD and 19.5% against USDT. Although the peg has since come back, USDC has lost 30% of its market-cap and has clearly been avoided by many crypto participants.

With the benefit of hindsight, we still believe the correct decisions were made during this period as our number 1 priority, particularly reinforced by our FTX experience, is the safety of investor assets.

2. March’s BTC Rally

Since its release, Bitcoin has been subject to many attempts to describe its place in the cross-asset world we live in:

The most common statement people make is, “It’s a hedge against inflation!” or “It’s a hedge against the debasement of the US Dollar!” or “It’s the next gold!” → and well... this thesis has been dragged through the mud in recent years. All it showed during the recent record inflationary period was that it was more duration sensitive than it was inflation sensitive.

The next thing we see is “It’s a hedge against geopolitical uncertainty!” → this theory probably cannot be truly tested without a full scale global war. For example, there were many stories of how Ukrainians had to rely on crypto transfers as well as crypto as a self-custody Store-of-Value (SoV) as they fled their nation, but this flow was not large in context of the entire crypto market and was not necessarily $BTC specific (and not much use if your new SoV loses over 60% in value throughout the year). To really test this theory, the war would need to be large enough that this flow becomes the main crypto narrative, not that the Fed is hiking 50 bps.

And finally, “It’s a hedge against the failure of the modern financial/banking system!” and a reappearance of the view “It’s the next gold!”, but this time from a SoV perspective → this was never taken seriously until the failure of the crypto banks in March. With $BTC being released after the 2008 Global Financial Crisis, this was the first time it could prove itself as digital gold and a sort of safe haven asset that investors flocked to as bank stocks dropped like flies around them. $BTC’s outperformance over $ETH during last month’s mini-banking crisis (Figure 2) seemed to indicate that the digital gold narrative, unique to Bitcoin and not a general “crypto” thing, was a real driver of price action:

And to this day, this final point is the widely accepted explanation for why $BTC rallied in March and outperformed its crypto peers that typically trade with a higher beta to it.

But we don’t buy this story at all, and we think that the rally was just initially driven by short covering from macro funds. We will attempt to unpack our reasoning:

EVERYONE WAS THE SAME WAY. Heading into the banking mess of last month, we were in those periods when the macro was “obvious”, evidenced by the consensus trades people had on: “higher inflation” trades, "higher-for-longer from the Fed” trades, “short big tech” trades, “value over growth” trades, etc. Positioning was VERY skewed and for some instruments like US 10yr Treasury futures, hedge fund positioning was the most extreme on record (data from CFTC). Prerequisite positioning condition for everything to correlate to 1 when sh*t hits the fan as everyone unwinds in the same direction.

Then... THE MARKET WAS ABSOLUTELY T-BONED. Relates to (1). Rates repriced massively. Within literally a few days, we went from markets anticipating a re-emergence of 50 bp rate hikes to collectively agreeing that the hiking cycle was suddenly over: in just 3-days from SVB, the market wiped out 6.5 rate hikes (of 25 bps) and almost 9 hikes at the peak (Figure 3). Recall, just a week before the SVB collapse, Powell went all-guns-blazing hawkish at his Congressional Testimony. And with funds all same-way as mentioned in (1), in the week following SVB, trend- following hedge funds had their worst 5-day stretch this century as per SocGen CTA Hedge Fund Index's 5-day returns.

BTC WAS JUST ACTING LIKE TECH STOCKS (AGAIN). The equity market was experiencing a major shift during this time. As Bloomberg’s Joe Weisenthal mentioned, comparing the NASDAQ-100 (heavily comprised of big tech) against the Russell 2000 (more exposed to regional banks and has cyclicality) shows the extent of this shift. The Russell had been outperforming NASDAQ for a year until suddenly in March, started surging, all the way to its highest level in a year (Figure 4). Plotting BTC against it shows that the rally did coincide (being careful here as we know correlation =/= causation) with NASDAQ’s huge outperformance, and given how macro-correlated crypto (and especially $BTC) has become, it is not surprising that it moved in the same direction as tech stocks did:

IN OUR VIEW, THIS ENTIRE ORDEAL WAS MEGA-BEARISH CRYPTO. Once Silvergate Bank and Signature Bank - the two major crypto banks that had almost oligopolistic control of their market - both went down, for almost every single large player in the crypto markets the instant on-ramp / off-ramp rails were destroyed (including for Orca Global). The effects of this were huge: for almost the first time USD fiat transfers in institutional crypto were halted, and for the few counterparties willing to keep this line open via traditional banking transfers, OTC USD quoted crypto trades became non-instantaneous settlement which then meant many market makers could not make markets in USD- denominated crypto pairs anyway. Hedge funds weren’t able to process investor redemptions into fiat and with most exchanges implementing a low notional limit for USD withdrawals, it became near impossible for any large crypto clips to be converted into fiat; for a few days, cryptocurrencies just became this weird magic internet money with zero real- world utility that existed in a world disconnected from the fiat payment system entirely. Even disregarding the pretty bearish macro backdrop of that week (we can all agree this was not a “risk-on” event), this was a major blow for the industry. The asset class that often touts the decentralisation aspect as a major strength was just called out by this entire tribulation and the over-reliance on centralised infrastructure such as traditional banks and payment systems became agonisingly clear.

Comment: As an aside, in our view however, this hypocrisy does not negate crypto’s decentralisation benefits but rather is merely an indication that for widespread adoption to materialise, Web 3.0 needs to find ways to co-exist with Web 2.0 without creating funnel points of risk. And this is only possible with if we work with regulators.

DIGITAL ASSET INVESTMENTS EXPERIENCED THE LARGEST OUTFLOW ON RECORD. After four consecutive weekly outflows, the week after the crypto banks went down, digital asset investments saw a total of $255mm outflows, the largest single weekly outflows on record (Figure 5, these refer to crypto products that traditional investors can trade such as GrayScale, 21Shares, CoinShares, ProShares etc.) BTC products led this move, compromising 95.7% of the outflows. The following week as $BTC continued to rally, BTC investment products saw $112.8mm outflows while short-BTC products saw $34.7mm of inflows.

MARKET COLOUR AT THE TIME WAS NOT SUPPORTIVE OF THE DIGITAL GOLD (BULLISH) NARRATIVE. We spoke to quite a few people across the industry from market makers in crypto to CME futures brokers to bank sales who facilitate crypto trades. And not a single person had a single client buying crypto (in spot or futures form) for "banking system has failed" reasons. We also spoke to crypto “whales”, those with a net worth in excess of $50mm, and none were buying $BTC on this banking failure event (in fact the consensus “biggest position” among these people was being long $ETH, which underperformed $BTC during this time as seen in Figure 2). The only non- short covering buyers we knew of were crypto native people who chased the moves after $BTC had already started pumping.

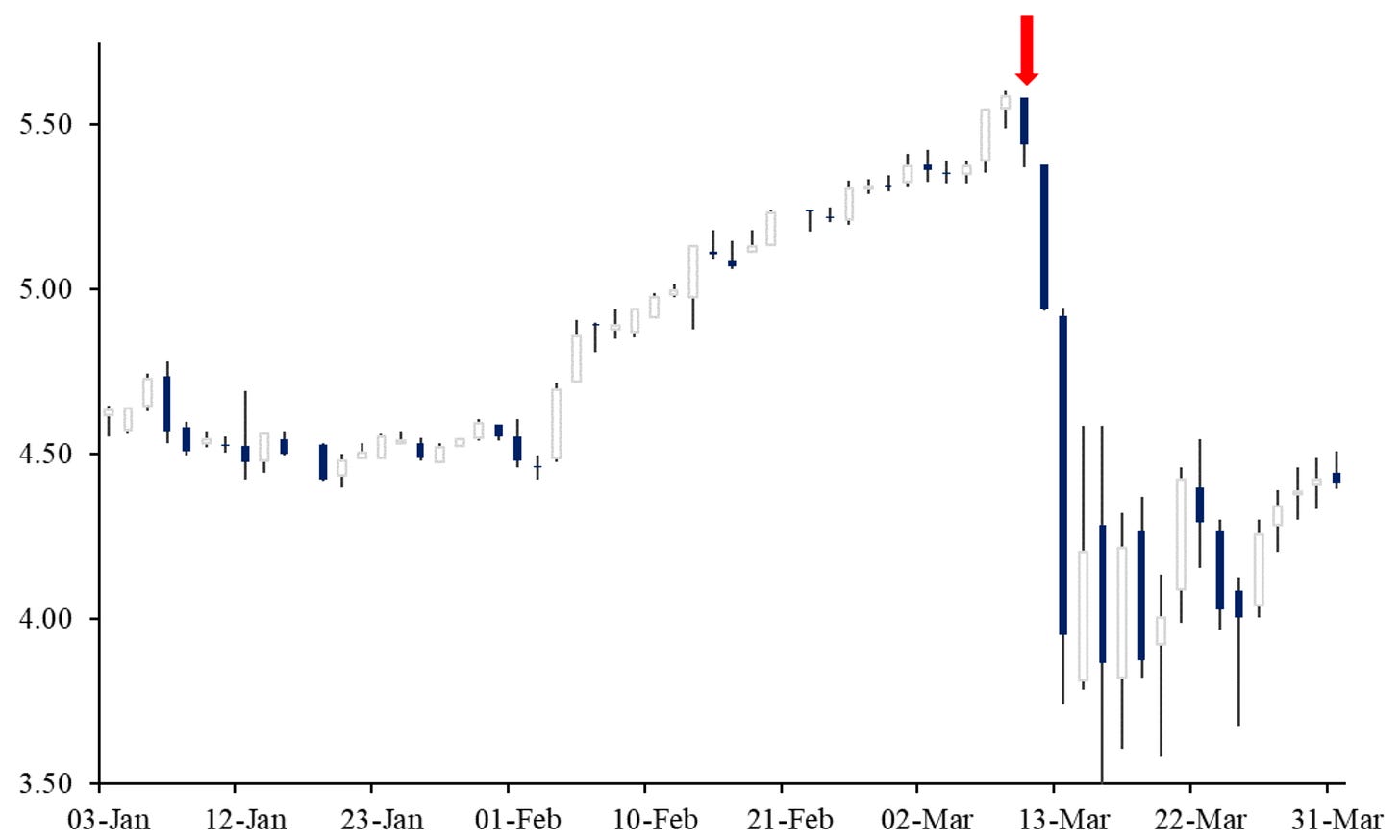

and finally... THE BTC MOVE WAS DRIVEN FROM CME FUTURES. On 13th March 2023 (the Monday after SVB + Signature went down and the day of the biggest moves), BTC CME futures saw the highest volumes on an up day in 4 years and the 2nd highest ever since the launch of BTC CME futures (Figure 6). The all-time-high was on 12th May 2019, when the price of BTC was 30% of what it was last month. On the other hand, crypto exchange futures and spot volumes were nowhere near as significant.

So to summarise:

everyone was positioned the same way (1),

then they were absolutely t-boned - some funds experienced the worst week this century, and presumably many had to post

collateral to their prime brokers (2),

$BTC was correlating with tech stocks again which saw large outperformance (3),

this was a mega-bearish event for crypto (4),

digital asset investments saw the largest ever weekly outflow which continued the following week whilst short-BTCproducts saw an inflow (5),

we failed to find anyone who bought $BTC for the widely accepted “hedge against banking system collapse” reasons (6) and finally,

BTC CME futures saw the 2nd largest up day volume ever on record while crypto exchange volumes were nowhere near as impressive (7).

Price action in $BTC was just an extension of crypto becoming a macro-correlated asset in recent years and the rally was driven by short closings by traditional hedge-funds, hence the bids via CME futures. The distinction of this theory from the currently accepted “$BTC rallied because of the cracks appearing in the traditional banking system” is important because it changes the very nature of the rally: an inflow of buyers at a time when trust in crypto is at an all-time-low is a very different scenario to large groups of bearish entities being forced to close their short positions simply to post collateral to their prime brokers. The former is a nod to $BTC’s status as a Store-of-Value and can lead to long-term $BTC ownership by probably a previously-skeptical bunch, while the latter is just a situation where bearish folks couldn’t afford to remain bearish as cross-asset correlations heightened during a large liquidation period.

I will let Joe Weisenthal put it altogether, as his summary is as good as it gets:

So for now, this rally does not look like a bet on imminent hyperinflation, banking system collapse, loss of trust in fiat currency or any other maxi meme. It looks more like a bunch of popular trades all got clobbered over the last couple of weeks, with extreme counter-trend moves in both directions.

And it was for this reason that after liquidating our positions, we remained flat in our discretionary strategy (however, we are long $BTC in our systematic momentum strategy).

Further Disclaimer:

The following important information relates to the use of Orca Global Management’s substack publications. Orca Global Management is a fund registered in the Cayman Islands. This publication is directed only at persons who: a) Are expert investors who fall within the definition of Accredited Investor b) Are otherwise permitted to read this publication in compliance with the governing laws of their respective jurisdiction. It is not directed at or intended for retail clients nor general public dissemination. Any person considering an investment into Orca Global Management’s fund must ensure that they are suitably qualified, experienced and knowledgeable on such investments considering jurisdictional rules, regulations and restrictions, tax implications, residence or domicile and their financial circumstances. Past performance is not a guide to what may happen in the future. Prospective investors should be aware that the value of their investments could fall as well as rise. Any investment carries the risk of potential total loss of capital and investors may not get back the value of their original investment. Information on this publication may include data and opinions derived from third party sources. Orca Global Management does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. Furthermore, the information provided does not constitute an offer to buy or to sell cryptocurrencies or any other financial instrument, nor does it constitute investment, legal or tax advice. Details relating to the investment including the risk disclosures can be found in the Private Placement Memorandum. This brief statement cannot disclose all the risks and other significant aspects of the various markets traded by Orca Global Management.