NOTE: This newsletter was written between 05~22nd July 2024 and originally sent to relevant recipeints on 22nd July 2024. Sensitive information has been redacted.

Contents:

Q2 Portfolio Review

Looking Ahead

Macro

See, macro is irrelevant

Just a bit on inflation (conclusion: stay long risk assets)

Election

Wrapping up the macro section (finally)

Crypto

BTC Dominance

Other things that are making

my balls tingleme bullish

Q3 Positioning

Other core position #1: ETH

Other core position #2 (very briefly): SOL

Other core position #3 (very briefly): LDO

Wrapping Things Up

Appendix

[——— redacted ———]

1. Q2 Portfolio Review

Macro risk assets in Q2 continued the 2024 trend upwards, with the S&P500 and Nasdaq100 continuing to hit all-time-highs throughout the quarter (Figure 1). Meanwhile, USD and yields topped in April, so if you had to guess crypto’s performance, particularly after such a successful BTC ETF launch, it would have been a fair guess to say “up”.

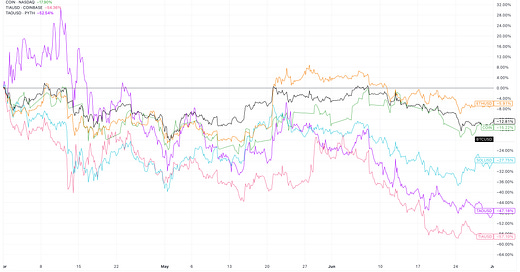

However, there was a distinct (and painful) disconnect between stocks and crypto last quarter. BTC and ETH were down -12.81% and -5.91% respectively, with many alts down 50% or more (Figure 2).

[——— redacted ———]

In mid-June about 80% of the portfolio delta was reduced via a basket of short perpetual futures due to a signalling from the systematic momentum strategy, and the portfolio components were adjusted in end-June. EDIT: most of this was written first week of July, but as of mid-July, the hedge (short positions) has been removed to bring the portfolio delta back to 100%.

As Figure 3 shows, the top 5 positions in order of size to start the quarter were the AI Basket, SOL, COIN, BTC, and TIA while the top 5 positions to end the quarter (after the rebalancing) were ETH, SOL, BTC, COIN, and tied between the AI Basket and LDO.

The portfolio remains ~80% hedged to both reduce the delta in this week environment and also gain small yield with our short perp positions (as mentioned in a previous EDIT, the hedge has been removed). Central to the rebalancing was the rotation from non-core positions (i.e. positions that were at risk of becoming stale or positions where the narrative didn’t come to fruition) into “the majors” i.e. BTC and ETH. The portfolio was underexposed to ETH, especially when considering inflows related to the eventual ETH ETF approval, so I structured the portfolio accordingly whilst also increasing the BTC exposure as a bet that the TradFi flow into BTC will continue to outperform the flows into other cryptocurrencies (BTC and COIN together is the biggest position and I categorise that as one position under the same thesis). There is an inherent assumption in this positioning that although we are in a bull market, we are a few steps away from “alt season” and that majors will outperform (as a reminder, typical crypto bull runs come in two stages: (1) at the start, $$$ flows into BTC (and ETH), (2) after the big coins rally, people venture along the risk curve to start bidding smaller and younger cryptocurrencies that end up outperforming the majors), but I will explore this in more detail in Section 2b below.

2. Looking Ahead

I am very bullish in 2024. I will cover some macro stuff, general crypto thoughts, and finish off with a bit on Q3 positioning.

2a) Macro

I will preface this section by saying that I think macro analysis is way overrated in crypto (it makes people feel smart). I also don’t like looking too deeply into macro stuff because I’m now a macro tourist - even when I BREATHED macro at a previous job, trading rates and talking about macro stuff every single day (I had no friends / I only had friends in macro), I still didn’t feel that I had an amazing grasp. As one of many Fed watchers, I traded the “primary instruments” (as opposed to “secondary”, i.e. things with a clear “pass through” in price action) like FF futures, EDs, etc. and I still wasn’t anywhere near perfect. Now I spend 1% of the time thinking about this stuff, investing in an asset class that has an unclear beta to macro and with a profoundly ambiguous pass through… it would be arrogant to think that I’d be able to get any alpha (if there even is any) from macro and apply it to crypto. So I like to keep everything high level, take cues from the “locals”, and have my thinking remain as a basic summary of what’s going on. Please feel free to ignore this section; you (and I) would be much better off listening to actual experts.

Anyway, I think the broad macro landscape is supportive of the crypto bull thesis. In this section I first go through an interesting development that I touched on earlier, then move on to exploring the main two narratives of 2024 - namely inflation/Fed and the US elections - that I think both point to being long crypto.

2a i) See, macro is irrelevant

I touched on it briefly in the Section 1 but the macro x crypto disconnect has been interesting to observe. When we take a look at the historical rolling correlation between SPX and BTC, the relationship has become increasingly sporadic from mid-2023 (Figure 4)

Recall, mid-June 2023 was when BlackRock’s BTC ETF intention was first reported. In Figure 5, we (try to) look past the choppy noise of Figure 4 to see how drastically the average correlation dropped in 2023.

The spot BTC ETF was meant to make BTC and the broader crypto market into “just another macro asset” - a notion I held too until last quarter when I watched stocks continue to climb upwards while my crypto-heavy net worth decided to head the other direction. So yeah, while I do think crypto has longer-term correlations to macro, for example in relation to global liquidity cycles, I remain firm in my belief that thinking too much about this unsolvable puzzle is not the best use a crypto investor’s time.

2a ii) Just a bit on inflation (conclusion: stay long risk assets)

Recap of the recent CPI print: June CPI was a lot milder than expected with core up 0.06%, lowering the 12-month rate to 3.27% (lowest in three years). While core goods have been in disinflation for a year now, the important detail was that the June disinflation was very broad based, particularly with shelter inflation cooling (woohoo).

In Figure 6, we take a look at the FF1!-FFZ4 chart (front-running Fed funds minus December 2024 Fed funds = proxy for market implied change in Fed funds from now until end of year).

The June CPI print caused the 5th biggest 1-day negative change in 2024, and the largest 10-day negative change this year, meaning it caused the most cuts to be priced in over a 10-day period. So although on an absolute basis the number of cuts priced in this year isn’t that exciting, when looking at the delta and velocity of how much the market became become dovish, we’re at the highest point YTD.

So far so good.

2a iii) Election

Moving on to the 2024 US election. Let’s talk about the man with 9 lives.

Trump is pro-crypto. Trump is so pro-crypto, that he has managed Biden and the Democrats to not only abandon their anti-crypto stance for this year, but actually pivot and pursue a pro-crypto attitude. Perhaps the best way to show the level of excitement the crypto market is in over a potential Trump presidency can be shown in Figure 7, which shows BTC price action around the assassination attempt in both 1 minute and 1 hour candles.

After the initial confusion, the market quickly expected the shooting attempt to be positive for Trump’s chances this year (obviously), and gave BTC the well-needed push to sustain above $60k. The remarkable efficiency of the crypto market to aside (if you missed it, crypto bros immediately created memecoins related to the shooting - truly the market that never sleeps), there’s not much else I can write about to showcase that a Trump win will be positive for crypto, but here is some recent news to further my point:

“If you’re in favour of crypto you’re gonna vote for Trump because they [Biden/Democrats] want to end it," (08May24) Trump said at a party in Mar-a-Lago.

“I AM VERY POSITIVE AND OPEN MINDED TO CRYPTOCURRENCY COMPANIES, AND ALL THINGS RELATED TO THIS NEW AND BURGEONING INDUSTRY. OUR COUNTRY MUST BE THE LEADER IN THE FIELD.” (26May24) - posted by Trump (yes, in all-caps).

"I will ensure that the future of crypto and the future of bitcoin will be made in the USA, not driven overseas. I will support the right to self custody … To the nation’s fifty million crypto holders, I say this: I will keep Elizabeth Warren and her goons away from your bitcoin, and I will never allow the creation of a central bank digital currency.: (26May24) - Trump said at the Libertarian National Convention in Washington DC.

It was reported that “Trump presented himself as a champion for cryptocurrency and slammed Democrats' attempts to regulate the sector” (07Jun24) at an SF fund raiser with high profile tech execs.

“We want all the remaining Bitcoin to be MADE IN THE USA!!!” (12Jun24) - posted by Trump hours after hosting a private dinner for American Bitcoin miners.

Later this month in July, Trump will speak at a Bitcoin conference in Nashville, Tennessee, and as George Kaloudis wrote in a CoinDesk OpEd, its “strange when presidential candidates spend time campaigning in states they have no risk of losing… And yet, Trump is stopping by a Bitcoin conference in the Volunteer State, during the immensely busy campaign season”, which highlights the importance of crypto in this election.

Further, Trump recently chose Senator J.D. Vance, who has a longggg history of being a crypto proponent, as his running mate. It’s impossible to quantify the effect of a Trump x Vance victory, but the US government (including the SEC) has been perhaps the biggest consistent headwind to crypto over many years. If this headwind turns into a tailwind, who knows how much higher crypto will be.

2a iv) Wrapping up the macro section (finally)

So from the overly simplified 30,000 foot view of the 2024 macro outlook, it’s pretty clear that I want to remain long crypto: the most recent inflation data and Fed expectations shows that we’re in the most supportive risk-on environments of 2024 so far, and if Trump does win in November, one of the largest crypto headwinds becomes a tailwind overnight. Powell’s favourite mouthpiece Timiraos teased the notion before the June CPI print but look out for the potential forward guidance at the July FOMC. In an environment where the world’s central banks enter a coordinated easing cycle, the most influential government is led by pro-crypto leaders, and the largest regulator pivots to being pro-crypto, what else would you rather own than BTC? So, “do I want to be long crypto?” is easy - absolutely yes. The harder question for me is “when will alts outperform majors?” (a tangential question to “what coins do I buy?”).

2b) General Crypto

2b i) BTC Dominance

As I mentioned in Section 1, crypto bull runs typically follow the 2-step process of BTC starting off the rally, and then altcoins following soon after. BTC is the main coin in crypto, and still seen as the industry’s “gold standard”. As macro conditions and general sentiment towards crypto favours bidding magical internet coins, the first wave of buying comes from capital outside crypto entering BTC. BTC outperforms the rest of the market, but a rising tide lifts all boats, and the positive feedback loop between crypto prices and sentiment starts. The second wave of buying comes from the “bull run rotation” with early BTC buyers rotating their profits down the risk curve into “altcoins” as well as new capital chasing higher highs in alts, kicking off what is famously known as “alt season” (or “altszn”). Obviously the music can’t go on forever, and as people FOMO in and outside capital comes in again to go even further out the risk curve and the ponzinomics of crypto is in full force, we see the classic overbought signals and we begin a bear market.

Here’s some analysis using this framework, updated from my Feb twitter post.

An interesting datapoint to watch is Bitcoin dominance (”BTC.D”), which is the market cap of BTC divided by the market cap of all crypto. Figure 8 shows BTC.D since 2018, and as you can see it typically bounces between 40~70%. What we want to see is the massive drop like we saw in the 2021 alt season, where the pump in alt L1s and their ecosystem coins far exceeded the BTC rally, pushing BTC’s dominance down while all coins went up.

As the total market cap goes up and we see more and more coins launch, particularly on the back of VC-backed coins TGE-ing (TGE = Token Generation Event = essentially a cryptocurrency’s ICO moment), it’s possible that the “new normal” (new range) is lower. Additionally with BTC’s potential diminishing returns (e.g., probably safe to assume BTC at $2,000 has much more upside potential in percentage terms than BTC at $75,000), I would be looking out for that second wave of a bull run at 60% BTC.D (rather than 70%) and at the bull run peak (i.e. where BTC.D bottoms) may be down at 30% (rather than 40%).

In Figure 9, we show the implied total crypto market cap in $trillion based on BTC price (rows) and BTC dominance (columns). As of writing (18Jul24), we’re at $65k BTC and 55% BTC dominance, putting the total crypto market cap at $2.33T (actual = 2.314).

I generally think any sort of price prediction in crypto, particularly for unprecedented price levels, is utterly useless, but here is my game plan (/what I ideally want to see happen). When relevant, I’ve included the corresponding total market cap based on Figure 9:

Stay overweight BTC and related positions (e.g., $COIN and $STX);

$2.33T total mcap ($65k x 55%)

Once BTC is clear above the ATH resistance price of ~$75k and in healthy price discovery, watch BTC lead the rally and BTC.D pushing towards 60%;

$3.29T total mcap ($100k x 60%)

As this happens, we should see some solid alt narratives developing. What the market is excited for here is important. This is when you want to develop your investment thesis and start rotating capital into altcoins with strong narratives.

As these alt narratives take off, and total crypto market cap continues to grow, BTC.D will stagnate and eventually start dropping.

Alt coins will be turbo bid, and the rallies we see here should be far greater than the BTC rally we saw at the start of the cycle.

BTC continues to grind up, but alts rally hard enough to bring BTC.D back down to at least 40%.

$6.17T total mcap ($125k x 40%)

If BTC.D drops down to 30%, the implied total mcap is $8.23T.

At $125k $BTC and 40% BTC.D, the total crypto market cap will be up 256% from now. In the new paradigm we live in, where Larry Fink consistently talks about crypto in his rare public appearances and both the White House and regulators potentially become pro-crypto, I think $125k BTC at the peak of the cycle is almost pessimistic. $125k is just under 120% from the previous cycle’s all-time-high in November 2021 - doesn’t seem too far-fetched if we can take a look at BTC’s historic peak-to-peak cycle returns (Figure 10).

2b ii) Other things that are making my balls tingle me bullish

The BTC bid is relentless: BTC was recently pushed down to the $55k level with Mt. Gox and the German government related selling. But considering that in their final week of selling the German government averaged 333.33 BTC per hour of selling ($20mm/hour or $480mm/day of selling at $60k BTC), I think the market has absorbed these “extremely bearish” flows quite well.

And as we know, exceptional bearish moments can make for great long entry points. Here are two noteworthy stats from July week 1 that I mentioned in Presto’s Daily Market Brief:

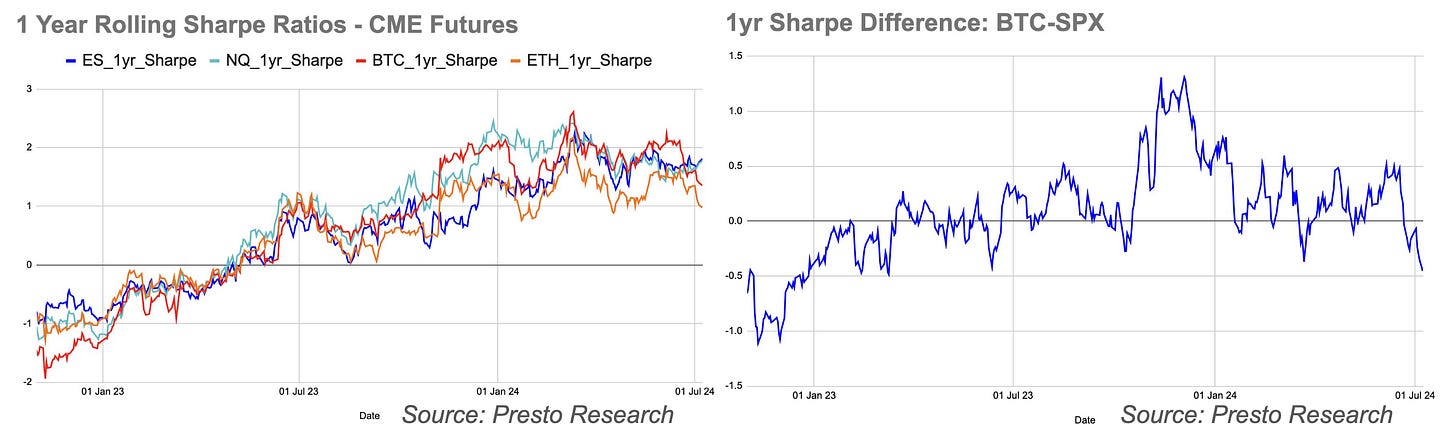

Crypto sharpe ratios are being left behind. Given crypto’s volatility and Q2 sell-off, sharpe ratios have been very mediocre. In fact, the difference in 1-year rolling sharpe ratios between BTC and SPX hit the most negative levels since March 2023, during the banking crisis.

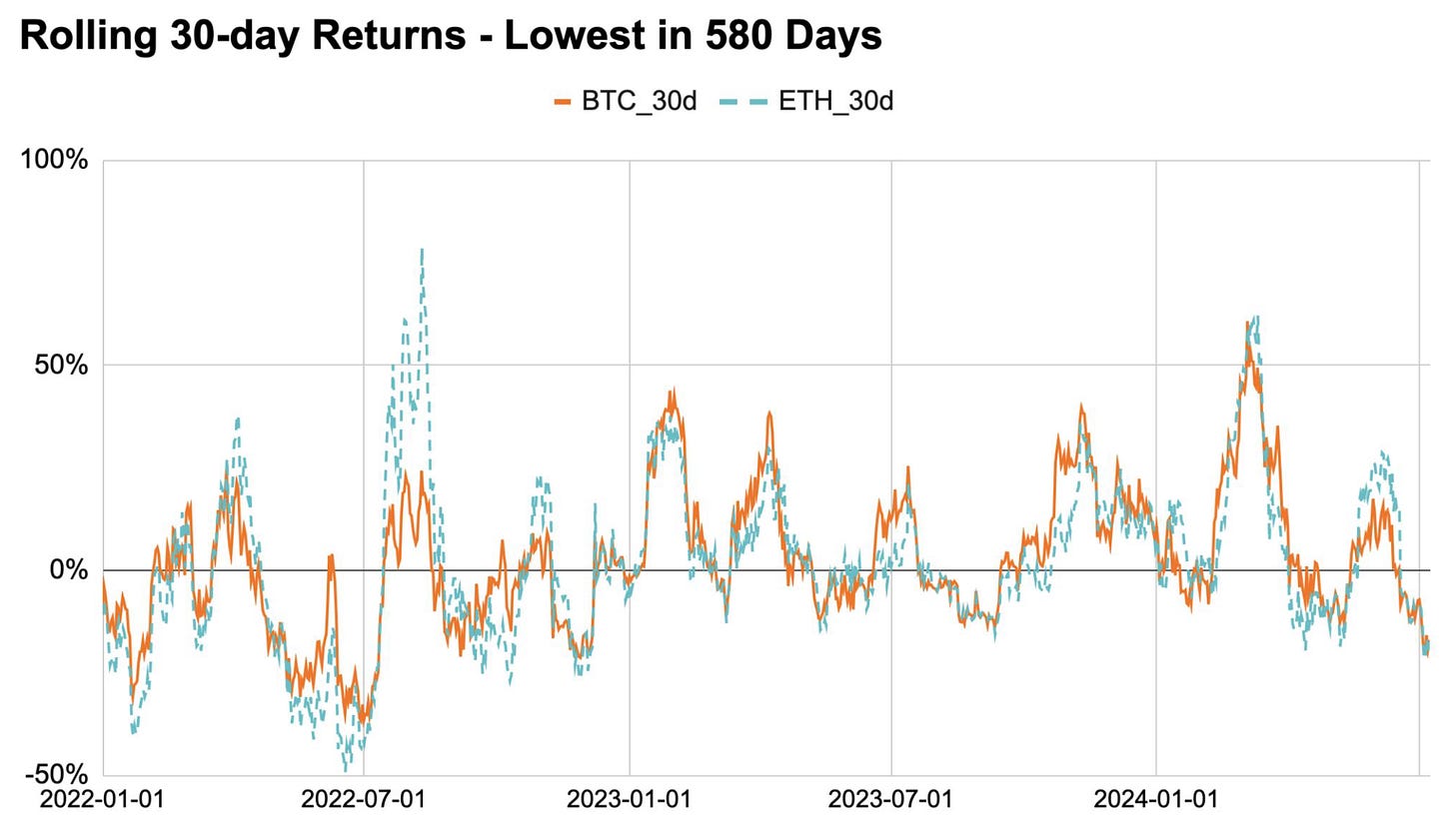

Worst returns since FTX. BTC and ETH both printed the worst 30-day returns since December 2022 (580 days).

And don’t forget, the 2024 BTC halving was only 3 months ago. I covered this topic for Presto Research but looking at historical post-halving rallies (Figure 13), we’re hardly scratching the surface of the bullish post-halving regime.

So to summarise, we’re in the most dovish macro environment YTD, there’s a potential Trump Presidency and ensuing pro-crypto US government coming up, and this is all in a bullish post-halving environment.

2c) Q3 Positioning

Given the above, I tend to think we’re still in the institutional phase of the rally, and stay overweight “blue-chip” coins. Collectively, BTC and COIN is the biggest position of the portfolio - I won’t elaborate too much on this (the bulk of this thesis comes from what I’ve already written) so instead, I will show some analysis for ETH and quickly skim over the other major positions SOL and LDO.

Other core position #1: ETH

ETH is a funny one, as I think the coin is both pricing in and under-pricing the ETF approval. Initially, I think the ETH ETF flows will be underwhelming making the event “priced in” at current levels, but longer term, I expect a massive repricing of sorts, where ETH rallies significantly and brings in impressive AUM. I think the asset managers will spin up a bunch of different ways to market the ETH ETF (e.g. world computer or ESG via PoS). At some point after launch, I expect the demand and volumes to exceed even the optimistic expectations. For a rough gauge of what the spot volumes for ETH is like with respect to BTC’s volumes, we can take a look at Figure 14, which compares the monthly volumes on Coinbase in 2021. 2021 is an arbitrary year I chose as a bull year but also before BTC had the anticipation of a spot ETF. On average, BTC did 1.34x the monthly volume in $ that ETH did, despite its 3x market cap advantage.

Since the Merge the amount of staked ETH has been increasing 4.19% monthly on average, which implies a 63.65% annual rate (Figure 15). At $3,500 ETH, that’s an average of $3.16B staked monthly, and if we use a linear projection, implies another 9.2mm ETH, or $32B to be staked by end of year. So if we consider staking as a form of circulating supply reduction, you basically have 0.75% of ETH’s market cap being taken out on a monthly basis via staking (9%/year!!!), as well as a negative supply growth of 0.13% (burn minus issuance), and combined with even a weak ETF demand, this will have to start affecting the price.

This is all a flip from my Q1 view that ETH was stuck in a bit of a dilemma where for a lot of narratives or bull theses, there were better coins to own and when thinking of a portfolio of finite $ and allocations, it was hard to justify bidding ETH. I think some of these concerns still remain but I have grown to think that a bullish repricing will happen.

So this is one of the few coins in crypto that has reached Lindy status, with a naturally declining supply, 9% of supply being staked annually, that has an ESG narrative, and despite a smaller market cap will offer the same access to TradFi demand via spot ETFs.

Other core position #2 (very briefly): SOL

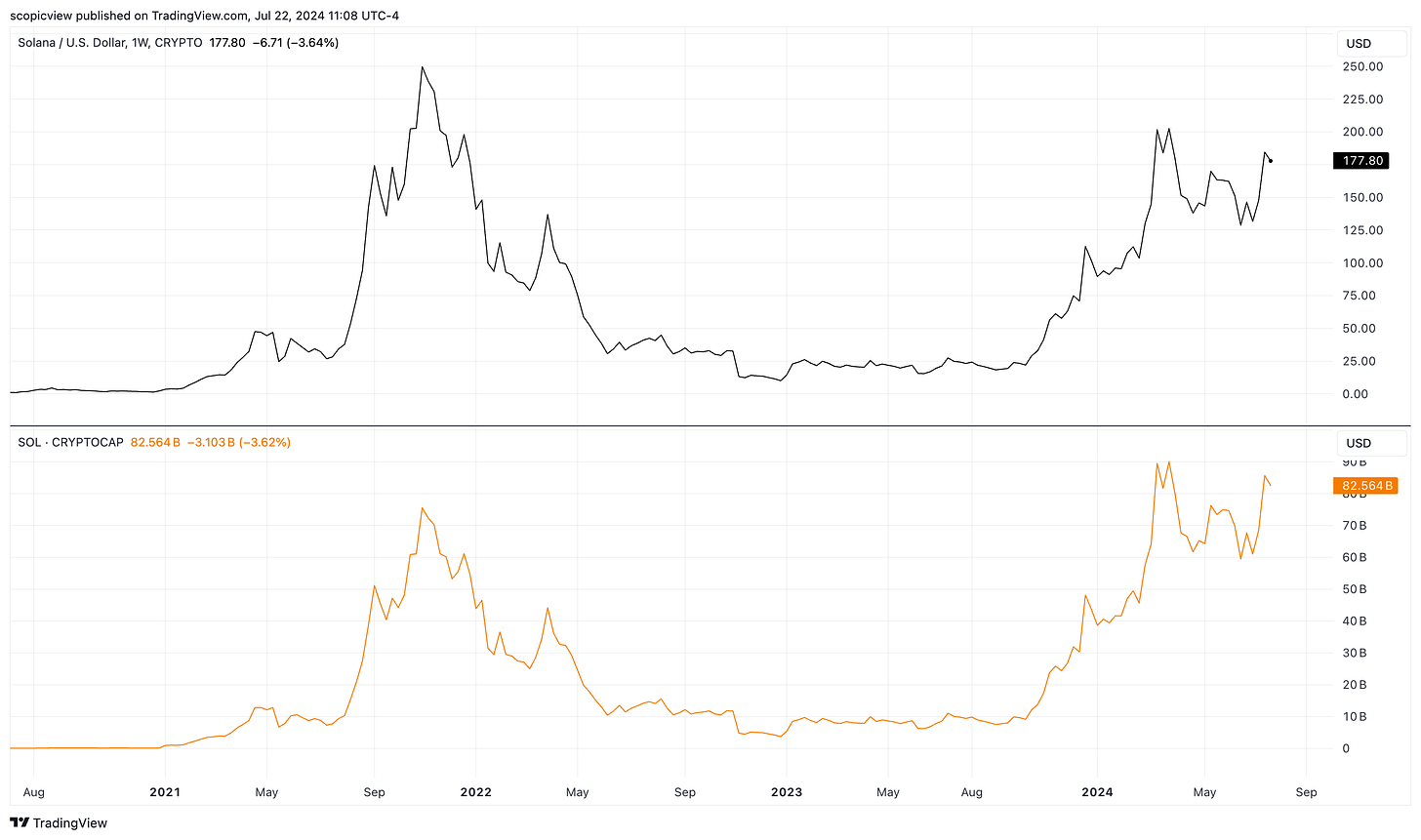

The Solana ecosystem over the previous bear market proved itself to be antifragile, and seemingly contrary to popular opinion, I think it has also become Lindy.

I think there are a lot of unquantifiable aspects of the ecosystem that make it unique, and I see it as an essential complement to the ERC ecosystem rather than a competitor L1. There is an undeniable ease in general UX due to the speed and low transaction fees, as well as the fairly solid suite of applications.

One thing I had been concerned about is Solana’s tokenomics (inflation rate / unlock schedule / etc.) and the issue can be visualised by comparing the SOL/USD price to the SOL market cap in Figure 16. Because of its tokenomics, despite Solana’s market cap reaching all-time-highs in March this year, the price was still ~20% below the previous ATHs from November 2021. In fact, today we would still need the price to rally about 50% to reach November 2021 levels, despite the market cap being 9% higher today. The current MC/FDV ratio is 80%.

Other core position #3 (very briefly): LDO

LDO experienced similar issues to Solana in regards to tokenomics. LDO’s market cap has 44x-ed since July 2021, yet if you had bought LDO then, your return would have been 0% (yes, zero). However, with the MC/FDV ratio of just below 90%, the issue has been declining.

Lido has proven to be part of DeFi’s critical infrastructure with its constant stETH dominance, and I chose this to be the portfolio’s DeFi exposure for now after the price dropped 10% on false rumours of an SEC Wells Notice.

My main concern is the spell LDO seems to put crypto participants, particularly those that did well in the last cycle, under. I’m under the impression that this is the main coin a lot of crypto natives are over-exposed to, with many accounts, big and small, posting bullish LDO tweets at every opportunity. On the limited days that LDO outperforms the market, I can almost guarantee “I told you so”-esque tweets on my timeline, despite it being down over 26% YTD. I think it’s good to own below $2 but given my existing exposure to ETH, there is a posisbility this will end up being less of a core component of the portfolio than those above.

I won’t delve too much into the AI basket, but collectively this remains somewhat sizeable in the portfolio even after getting rid of a few components because of how well a few coins performed in Q1. As I wrote in the Q4 2023 Newsletter (only available to relevant recipients), I like to let winners ride unless I have clear reasons to take profit.

Separately, one ecosystem/chain that I may be underexposed to is TON (the Telegram chain), and I plan to study this in detail in the coming weeks.

3) Wrapping Things Up

I think I did a lot of mini wrap ups and summaries throughout this note, so I don’t want to be too repetitive but here’s a bulleted list of what I discussed:

Very bullish into year-end;

Although not a clear signal, inflation and Fed expectations have become remarkably supportive of risk-assets;

A Trump election win would be turbo bullish crypto;

It’s only been 3 months since the BTC halving;

Given bull-market dynamics, I will observe BTC.D alongside general prices, and continue to be overweight BTC and blue-chip coins during this part of the bull market, with plans to rotate into altcoins based on sector specific narratives later on;

That’s about it. Stay long, stay optimistic, and hopefully see you on the other side of $100k (not financial advice, but you should believe in something - take a chance).

Appendix A:

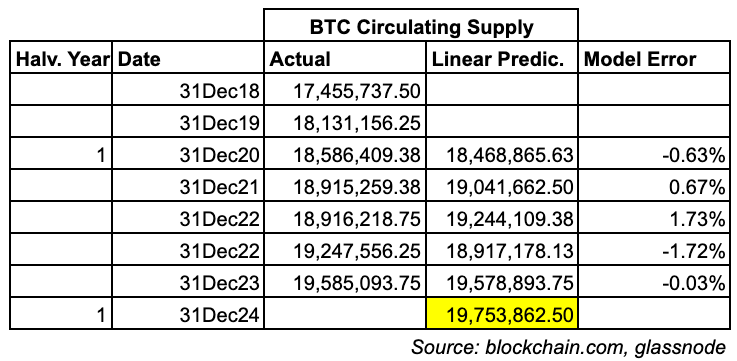

The BTC supply number in Figure 9, and for the following calculations was derived from using a simple linear model (crudely taking into account halving years):