Orca Global: September 2022 Investment Newsletter

Disclaimer: This page, including any links or posts, is not an offer or invitation to subscribe for shares in the fund. Please read the full disclaimer at the end of this page.

This was originally sent to investors of Orca Global Management on 17 October 2022.

Update on leverage

We started using leverage in one of our strategies to free up USD collateral. This will only affect a specific sub-account dedicated to our Relative Value strategy implemented on one of the centralised exchanges we use. The RV portfolio is a delta-neutral strategy with ~20 positions each on both the long and short side. The most at-risk single position is a short position where the current mark price is 1680% away from the liquidation price (as of 15th Oct 2022). With the number of positions spread across the long and short side, as well as the USD buffer we have included in the sub-account, we deem it highly unlikely that this will cause any margin issues.

Even if we do experience collateral issues, any “blow-ups” or position liquidations will be limited to this sub-account and will not affect any other account even within the exchange we are using. Although our simulation model points to any issues being completely unrealistic, we are acutely aware of any risks of far tail events and will continue to systematically monitor any changes in the USD buffer and are ready to make any discretionary changes to at-risk positions.

What happened in September? Merge vs. Macro

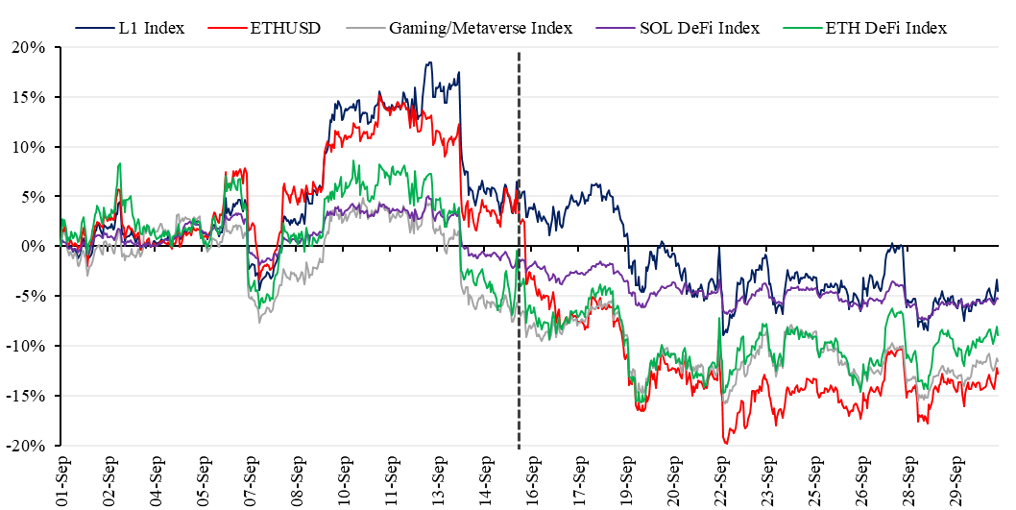

After years of delays, the most anticipated event in crypto history, Ethereum’s transition from Proof-of-Work to Proof-of-Stake (the “Merge”), was finally executed (successfully and without trouble) on the 15th of last month (denoted by the grey dotted vertical line in Figure 1).

However, as to many people’s disappointment and to continue the theme for 2022, the macro headwind was yet again enough to overwhelm the crypto narratives. It is true that the Merge was well advertised and perhaps “priced in”, but considering this was undoubtedly the most significant event in this industry, as well as one of the biggest (if not the biggest) software update in history to happen without any downtime (i.e. there was no stoppage or changes in user experience as the Merge happened), it was a bit shocking just how little impact on price action the actual event had. In fact, $ETH underperformed the rest of the market over the month of September (Figure 1).

We believe the disappointing $ETH returns for September, underperforming returns of even Ethereum DeFi tokens (Figure 1), was driven by both Merge related flows and the macro factors. The Merge related flows were unwinds of long spot positions that were put on to receive ETH PoW tokens via airdrops (often coupled with a short ETH futures position to maintain delta-neutrality) while the macro narrative was very much a risk-off one, particularly from the middle of the month; even bonds were a sell in September (Figure 2).

That culprit of the steep drop on the 13th, both in Figure 1 and 2, was the US inflation data where MoM and YoY prints for CPI and core CPI all beat expectations considerably, reminding investors that inflation had not peaked in April or July. The price action in the charts make it clear that the inflation print was a huge driver for crypto markets as well, but the asset class did well to stabilise towards the end of the month.

We covered a bit on the Merge in last month’s newsletter. If you would like more information on what it is and what this means for both Ethereum and crypto in general going forward, please let us know.

Portfolio Update

On the long market side, we are currently running 4 sub-portfolios:

Quality: what we consider blue-chip tokens with high beta

Frontier: under the radar, lower market-cap and lower beta projects

Leveraged beta: high correlation tokens that trade with a leveraged beta to the market

Non-linear: directional options trades

Against our long market positions we run a systematic hedge sub-portfolio composed of options positions and synthetic shorts, where the combined delta of these are currently (mostly out-the-money) just less than half of the delta in our combined long sub-portfolios. In September, our hedge portfolio returned 42.61% (=PnL/premium), largely offsetting our unrealised losses from our long positions.

For a while now we have been trading light, with our largest strategy currently being delta-neutral trades. We have various target portfolio breakdowns that we can rotate into very quickly (the overwhelming majority of what we trade are highly liquid) that we have determined to be optimal under varying market assumptions (e.g. markets flat over a month, +5%, -5%, +10%, etc.).

With BTC (and a lot of cryptocurrencies) showing technical signs of consolidation (Figure 3), as well as short tenor Implied Volatility coming down to the lows of the year (Figure 4), we are watching any and all developments like hawks with an expectation of a breakout, ready to pivot into our various target breakdowns. We are also working on a portfolio optimisation system that can programmatically return optimal portfolio constructions for various market assumptions.

Interesting Events in September

The Merge happened smoothly for Ethereum on 15th September

A South Korean court issued an arrest for Terra (LUNA)’s Do Kwon. It has also issued warrants for the arrest of two other Terraform Labs employees, with all three based in Singapore according to The Block

Wintermute (one of the larger crypto native market makers) was hacked for $160 million in their DeFi operations

Further Disclaimer:

The following important information relates to the use of Orca Global Management’s substack publications. Orca Global Management is a fund registered in the Cayman Islands. This publication is directed only at persons who: a) Are expert investors who fall within the definition of Accredited Investor b) Are otherwise permitted to read this publication in compliance with the governing laws of their respective jurisdiction. It is not directed at or intended for retail clients nor general public dissemination. Any person considering an investment into Orca Global Management’s fund must ensure that they are suitably qualified, experienced and knowledgeable on such investments considering jurisdictional rules, regulations and restrictions, tax implications, residence or domicile and their financial circumstances. Past performance is not a guide to what may happen in the future. Prospective investors should be aware that the value of their investments could fall as well as rise. Any investment carries the risk of potential total loss of capital and investors may not get back the value of their original investment. Information on this publication may include data and opinions derived from third party sources. Orca Global Management does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. Furthermore, the information provided does not constitute an offer to buy or to sell cryptocurrencies or any other financial instrument, nor does it constitute investment, legal or tax advice. Details relating to the investment including the risk disclosures can be found in the Private Placement Memorandum. This brief statement cannot disclose all the risks and other significant aspects of the various markets traded by Orca Global Management.